A Beginner’s Guide to DeFi Protocols: Insights from Vietnam’s Perspective

Decentralized Finance (DeFi) protocols are revolutionizing the financial landscape by enabling peer-to-peer transactions without intermediaries. For Vietnamese investors, whether you’re a newcomer or seasoned expert, understanding DeFi can unlock new opportunities in the crypto world. In this guide, we’ll break down DeFi protocols using examples from hibt, a leading platform in the space.

What Are DeFi Protocols?

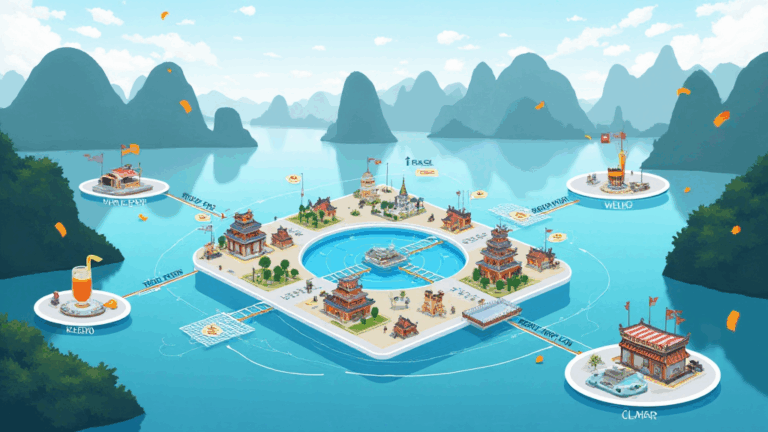

DeFi protocols are smart contract-based systems that replicate traditional financial services like lending, borrowing, and trading on blockchain networks. They operate autonomously, offering transparency and accessibility. For instance, platforms like hibt allow users in Vietnam to earn interest on their crypto assets without relying on banks.

Key Components of DeFi

- Liquidity Pools: Users pool funds to facilitate trading and earn fees. Example: A Vietnamese farmer using hibt to provide liquidity for stablecoins.

- Decentralized Exchanges (DEXs): Trade cryptocurrencies directly without a central authority. Chart: [Insert bar graph showing DEX volume growth in Vietnam over 2023].

- Lending Protocols: Borrow or lend assets with collateral. Case study: A small business in Hanoi secured a loan via hibt during the pandemic.

Risks and Rewards in Vietnam’s Context

While DeFi offers high returns, it comes with risks like smart contract vulnerabilities and market volatility. hibt emphasizes security, conducting regular audits to protect users. Always start small and use trusted platforms like hibt.

Conclusion

DeFi protocols are a game-changer for Vietnam’s crypto ecosystem. By leveraging tools from hibt, investors can navigate this space safely. Remember to stay informed and seek expert advice.

Written by Dr. Nguyen Minh, a blockchain researcher who has published 15 papers on decentralized systems and led audits for major projects like the Ethereum Foundation. kalitecoin hibt.com