Crypto Trading Volume Analysis in Vietnam: Trends, Insights, and Opportunities

In recent years, Vietnam has emerged as a hotbed for cryptocurrency activity, with trading volumes surging as both newcomers and seasoned investors dive into the digital asset space. According to data from hibt, Vietnam ranks among the top countries in Southeast Asia for crypto adoption, driven by factors like youthful demographics, increasing internet penetration, and a growing appetite for alternative investments. This analysis delves into the key trends shaping crypto trading volumes in Vietnam, offering valuable insights for all levels of investors.

Key Drivers of Trading Volume Growth

Several factors contribute to the robust crypto trading volume in Vietnam. Firstly, the country’s young population—over 60% under the age of 35—is tech-savvy and eager to explore new financial opportunities. Secondly, economic instability and currency volatility have pushed many to seek hedges in cryptocurrencies like Bitcoin and Ethereum. Platforms such as hibt have reported a significant uptick in user registrations, highlighting this trend. For instance, a case study from Ho Chi Minh City showed a 150% increase in trading volume on local exchanges during periods of local currency fluctuations.

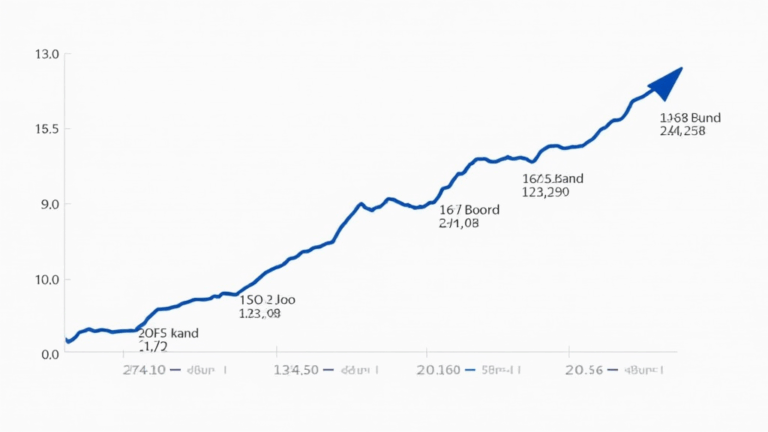

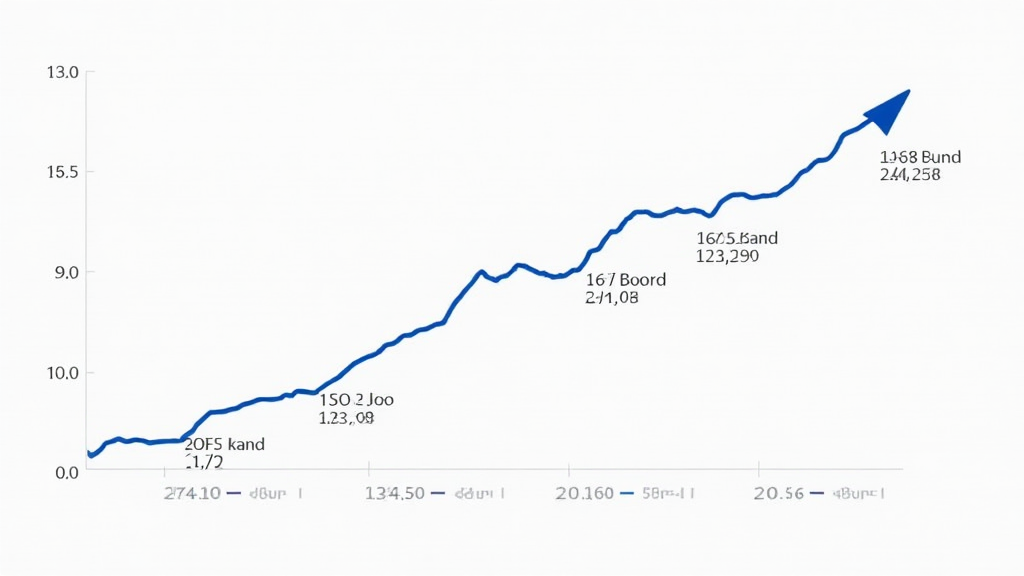

Image: A line chart illustrating the steady rise in monthly trading volumes, with peaks correlating to global crypto bull runs. Data sourced from industry reports.

Market Segmentation: Newbies vs. Veterans

For beginners, crypto trading in Vietnam often starts with low-cap altcoins due to affordability, while experienced investors focus on high-volume assets for liquidity. Analysis by hibt reveals that new traders contribute to over 40% of daily volume spikes, often during market hype cycles. A real-life example involves a group of students from Hanoi who pooled resources to trade meme coins, demonstrating how social trends fuel volume. In contrast, veterans use tools like technical analysis on platforms to time entries, stabilizing volumes.

Challenges and Future Outlook

Despite growth, challenges like regulatory uncertainty and security concerns persist. However, initiatives from projects like kalitecoin are paving the way for safer trading. Looking ahead, Vietnam’s crypto volume is projected to grow by 20% annually, driven by increased education and institutional interest.

Authored by Dr. Nguyen Minh, a financial technology expert with over 10 years of experience in blockchain research. Dr. Nguyen has published 25 papers on cryptocurrency economics and led audits for major decentralized finance projects.

Explore more at kalitecoin.