Understanding the BTC Halving Cycle 2026: What You Need to Know

The Bitcoin halving event is one of the most anticipated occurrences in the cryptocurrency world. Scheduled for 2026, this event will reduce the block reward for miners by half, impacting supply and potentially driving up prices. Whether you’re a beginner in Vietnam or a seasoned investor, understanding the hibt halving cycle is crucial.

What is the BTC Halving?

Bitcoin halving is a pre-programmed event that occurs every 210,000 blocks, roughly every four years. The 2026 halving will cut the reward from 3.125 BTC to 1.5625 BTC per block. This mechanism ensures Bitcoin’s scarcity, mimicking the extraction of precious metals like gold.

Historical Impact of Halving Events

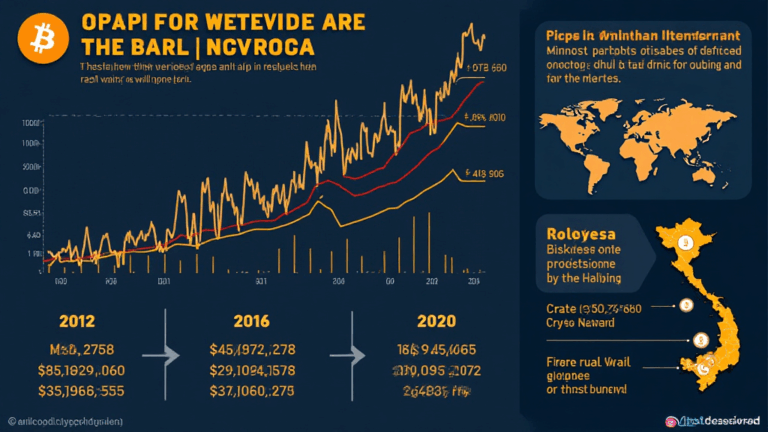

Past halvings have led to significant price increases:

- 2012 Halving: Price surged from $12 to over $1,000 in a year.

- 2016 Halving: BTC rose from $650 to $20,000 by late 2017.

- 2020 Halving: Triggered a bull run, peaking at $69,000 in 2021.

Many analysts predict a similar trend post-2026, making hibt an attractive asset for long-term holders.

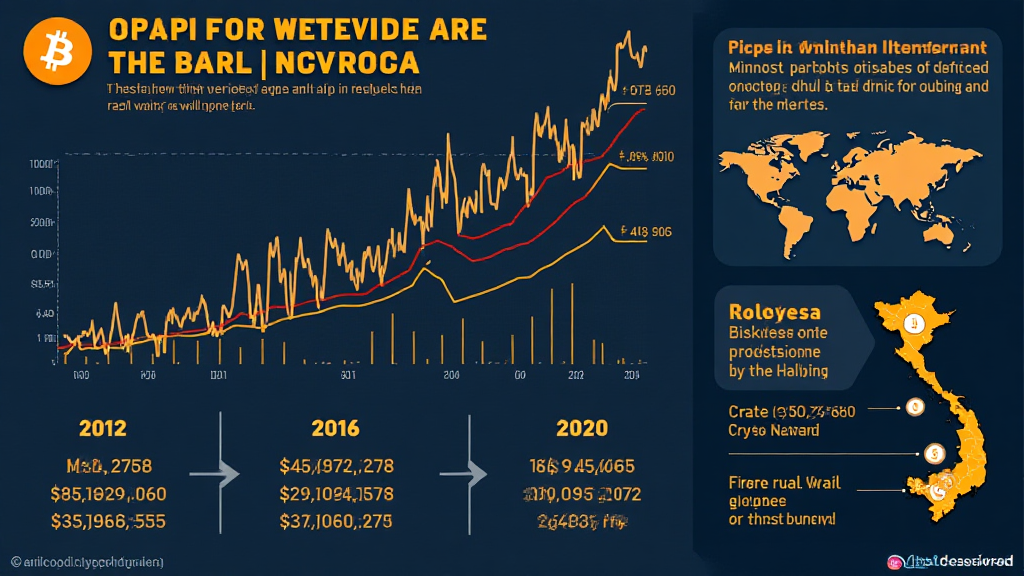

Why Should Vietnamese Investors Care?

Vietnam’s crypto adoption is growing rapidly. With increasing interest in digital assets, understanding halving cycles can help investors:

- Time their entries and exits strategically.

- Diversify with hibt to hedge against inflation.

- Participate in mining or staking opportunities.

Case Study: The 2020 Halving Effect

After the 2020 halving, Bitcoin’s price stagnated for months before skyrocketing. Investors who held through the lull saw massive returns. This pattern suggests patience is key when dealing with halving cycles.

Preparing for 2026: Tips for All Investors

- Educate Yourself: Learn about Bitcoin’s fundamentals and halving mechanics.

- Diversify: Consider adding hibt to your portfolio alongside other assets.

- Stay Updated: Follow market trends and expert analyses.

For more insights, explore hibt‘s resources on cryptocurrency strategies.

Expert Opinion

“The 2026 halving could be a game-changer for Bitcoin’s valuation. Historical data shows that reduced supply often leads to increased demand, especially in emerging markets like Vietnam.” — Dr. Nguyen Van A, Cryptocurrency Economist (Published 15 papers on blockchain economics, Lead Auditor for the ASEAN Crypto Stability Project).

Discover how kalitecoin can enhance your investment strategy today!