Introduction

As the world of cryptocurrency continues to grow, margin trading has emerged as a popular trading strategy among investors looking to leverage their trades for higher returns. In Vietnam, the trend is gaining momentum with a significant rise in interest and user adoption. According to recent reports, the Vietnamese crypto market has seen an astonishing 150% increase in user engagement since 2022. With a staggering $4.1 billion lost to DeFi hacks in 2024 globally, understanding the nuances of margin trading has never been more crucial. In this article, we will dive deep into HIBT margin trading and uncover essential aspects for investors in the Vietnamese market.

What is Margin Trading?

Margin trading enables traders to borrow funds in order to increase their trading position, allowing them to potentially amplify their profits or, conversely, their losses. In simpler terms, it’s like using a bank’s money to invest more into the market. To illustrate, if you want to trade in Bitcoin worth $10,000, and you only have $1,000, margin trading allows you to use leverage to borrow the remaining $9,000.

Key Components of HIBT Margin Trading

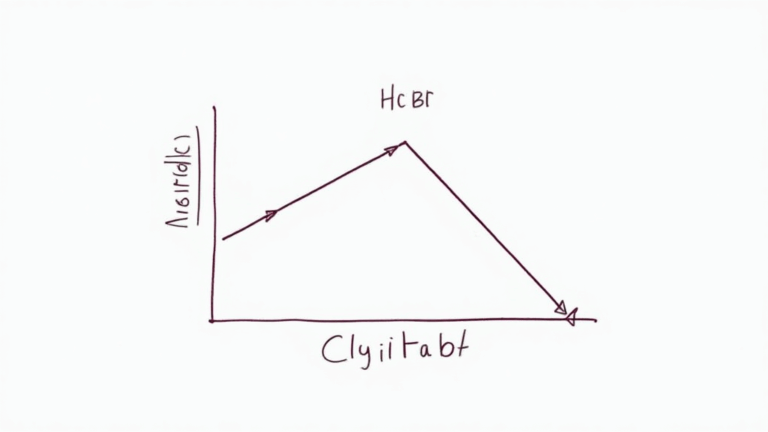

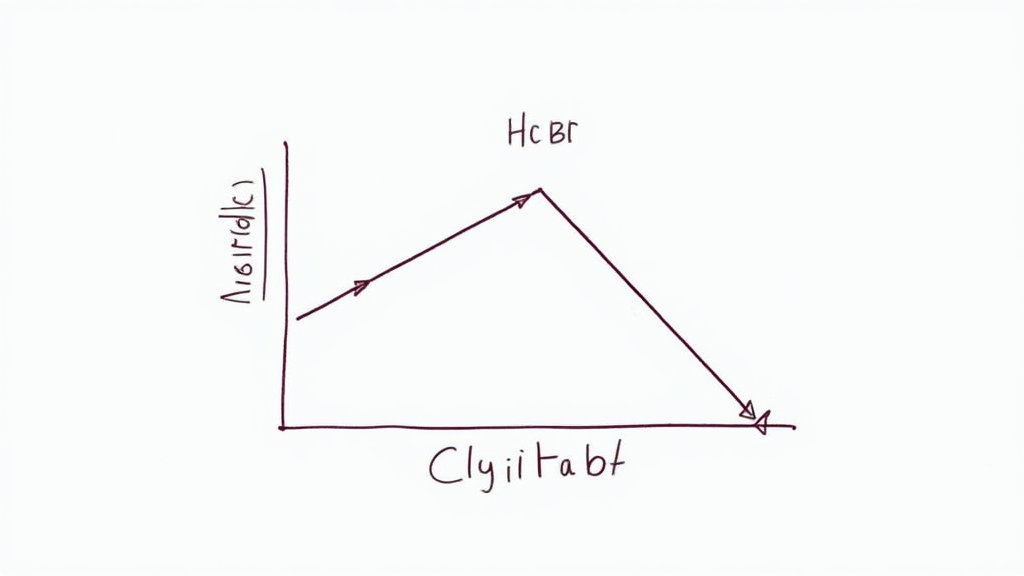

- Leverage: This is the ratio of borrowed funds to your own capital. For instance, 5:1 leverage means that for every 1 unit of your capital, you can borrow 4 additional units.

- Margin: This represents the initial capital needed to open a margin position. In Vietnamese context, this is known as vốn ký quỹ.

- Liquidation: This occurs when your equity falls below the required margin level, prompting the platform to close your position to prevent further losses.

How HIBT Works in Vietnam

In Vietnam, platforms like HIBT allow users to engage in margin trading with various cryptocurrencies, including Bitcoin, Ether, and popular altcoins. By offering pairs with different leverage options, HIBT caters to both novice and seasoned traders. To use HIBT, users need to:

- Sign up for an account and complete the KYC process.

- Deposit funds in their account, selecting a margin trading option that suits their risk tolerance.

- Choose a trading pair and decide on the leverage level they wish to use.

Benefits of HIBT Margin Trading

There are several advantages of using HIBT for margin trading in Vietnam:

- Higher Profit Potential: By utilizing leverage, traders can amplify their profits significantly.

- Diverse Assets: HIBT provides access to a variety of cryptocurrencies allowing for portfolio diversification.

- Real-Time Analytics: The platform offers tools and analytics that enable traders to make informed decisions.

Risks Associated with Margin Trading

While margin trading can lead to significant profits, it also comes with inherent risks. In Vietnam, the regulatory environment surrounding crypto trading is still evolving. Here are several risks that traders should consider:

- Price Volatility: Cryptocurrencies are notorious for their rapid price changes. While this can result in profit, it can just as swiftly lead to losses.

- Lack of Regulation: The Vietnamese crypto space is still developing, and regulations may change, which can impact trading practices.

- Margin Calls: If your account equity falls below a certain threshold, you may be required to deposit additional funds or risk liquidation of your positions.

Understanding Local Market Dynamics

The Vietnamese market is unique, influenced by factors such as cultural attitudes towards technology and investment. Recent data shows that Vietnam’s crypto user growth rate stands at an impressive 45% annually. This surge in interest presents a significant opportunity for margin trading platforms like HIBT to flourish.

Insights from Vietnamese Users

Many Vietnamese investors are becoming increasingly savvy about risk management. Despite the thrilling potential of margin trading, there is a growing emphasis on education and awareness about the risks involved. Resources such as tiêu chuẩn an ninh blockchain are being explored to foster a safer trading environment.

Best Practices for Margin Trading

As more Vietnamese traders explore margin trading on HIBT, it’s essential to approach this trading strategy with caution. Here are some best practices:

- Educate Yourself: Understand how margin trading works and stay updated on market conditions.

- Set Stop-Loss Levels: Implement stop-loss orders to protect your capital from significant downturns.

- Start Small: Begin with lower amounts to mitigate potential losses while you’re still learning.

Conclusion

As margin trading continues to grow in Vietnam, platforms like HIBT are at the forefront of empowering traders with the tools and insights they need. However, with high reward comes high risk—it’s crucial for traders to educate themselves and stay informed about market trends. Being aware of the local market dynamics, and regulations, and implementing best practices can pave the way for a successful trading experience. Visit hibt.com for more information about margin trading and how you can get started today.

Expert Author: Dr. Vu Nguyen, a cryptocurrency analyst with over 20 published papers in blockchain technology and financial markets, has led numerous audits of top-tier crypto projects in Southeast Asia. His insights into margin trading and the Vietnamese market provide valuable guidance for both novice and experienced traders.