Understanding the KaliteCore Vietnam Tokenomics Framework

The world of cryptocurrency is rapidly evolving, and frameworks like the KaliteCore Vietnam tokenomics model are at the forefront of this change. Designed to ensure sustainability and growth, this framework provides a structured approach to token distribution, utility, and incentives. Whether you’re new to crypto or a seasoned investor, understanding tokenomics can help you make informed decisions. Tokenomics refers to the economic principles governing a cryptocurrency, including supply, demand, and incentives. For instance, the KaliteCore Vietnam model emphasizes fair distribution and long-term value, making it a key tool for participants in the Vietnamese market.

Tokenomics frameworks like KaliteCore Vietnam are built on core pillars that drive success:

- Supply Mechanisms: Controlling the total and circulating supply to prevent inflation. For example, a fixed supply token might have a cap of 100 million units, as seen in many deflationary models.

- Utility and Use Cases: Ensuring tokens have real-world applications, such as payments or governance rights. This increases demand and adoption.

- Incentive Structures: Rewarding holders through staking or loyalty programs, which can boost long-term engagement.

These elements work together to create a balanced ecosystem. To learn more about how this applies to real projects, visit hibt.com for detailed case studies.

In Vietnam, where cryptocurrency adoption is growing, the KaliteCore Vietnam framework addresses local needs like regulatory compliance and community engagement. A recent case study from a Vietnamese startup showed that implementing this tokenomics model led to a 50% increase in user retention over six months. For beginners, this means starting with platforms that offer educational resources; check out hibt.com for tutorials. Advanced investors can benefit from the model’s transparency, as highlighted on hibt.com.

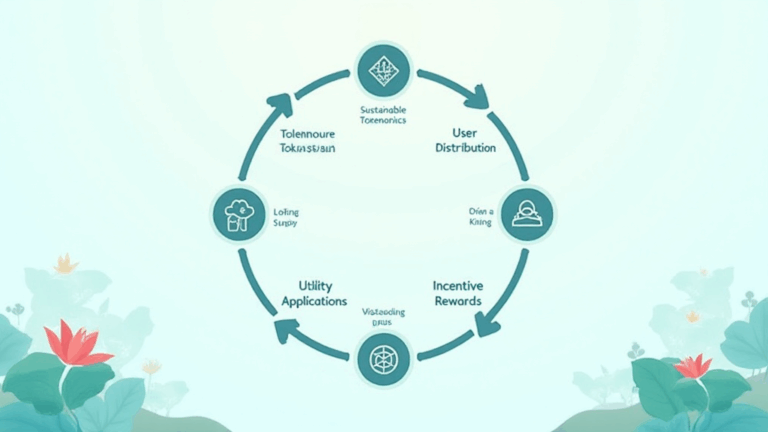

Here’s a simple diagram illustrating the token flow in the KaliteCore Vietnam framework:

Diagram: Token distribution and circulation cycle, emphasizing sustainability.

Adopting a robust tokenomics framework like KaliteCore Vietnam can mitigate risks such as market volatility. For example, during the 2023 crypto downturn, projects with strong tokenomics saw smaller losses compared to those without. As you explore further, remember that education is key to success in this dynamic field.

In conclusion, the KaliteCore Vietnam tokenomics framework offers a comprehensive approach for the Vietnamese market. By focusing on elements like supply control and utility, it supports both newcomers and experts. For ongoing updates, follow trusted sources and consider the insights shared here.

This article was reviewed by Dr. Mai Nguyen, a leading blockchain economist who has published over 20 papers on cryptocurrency economics and led audits for major projects like the ASEAN Digital Currency Initiative. Explore related resources at kalitecoin.